Cape Verde as a destination for foreign investment and business

1. Gross Domestic Product (GDP)

Cape Verde's GDP reached USD 2.5 billion in 2022. This represents an increase of 3.5% over the previous year. Over the past 10 years, Cape Verde's GDP has grown by more than 50%, despite the fact that Cape Verde was hit hard by the 'Covid 19' pandemic, which crippled a major source of income, tourism. The remarkable growth in Cape Verde's economic performance is due to a number of factors, including the development of tourism, fishing and agriculture.

2. Inflation

Inflation in Cape Verde is expected to be around 2.7% in 2023. This inflation rate is relatively low, indicating price stability and providing cost predictability for investors. Cape Verde's inflation rate is 2.5% in 2022. This is lower than the average inflation rate in Africa, which is 6.5%, and dramatically lower than that of the Czech Republic (14.8%!).

3.Interest rates

Cape Verde's benchmark interest rate was last recorded at 1.25%. This low rate is attractive to investors as it reduces the cost of financing. Interest rates in Cape Verde reached 8.5% in 2022. This is lower than the average interest rate in Africa, which is 10%.

4.Political stability

Cape Verde is a politically stable country with a history of parliamentary democracy and economic freedom unique in the region. Elections are free, fair and regular, and there have been smooth transitions of power since independence from Portugal in 1975. It is a democratic republic with a pluralist political system. There has been no political unrest in the country in recent years.

5.Legal framework

The Cape Verdean legal system is based on civil law. Cape Verde is one of the countries with an efficient judicial system and asset protection, which makes it more attractive to investors. The Cape Verdean legal framework is therefore stable and predictable. The country has a constitution that protects fundamental human rights and freedoms. Cape Verde is also a member of the International Court of Justice.

6.Tax conditions

The tax environment in Cape Verde is favourable. The country offers a number of tax incentives for investors, including the possibility of exemption from corporate income tax. Under Cape Verde's Tax Law 2022, legal entities incorporated in Cape Verde and having their registered office or principal place of business in the country are exempt from corporate income tax for the first 10 years of their existence. This exemption applies to all types of income, including income from business activities, investments and the sale of assets. In addition to the corporate tax exemption, Cape Verde also offers other tax incentives for investors, such as

-

Exemption from income tax for employees of foreign companies established in Cape Verde

-

Tax incentives for exporters.

-

Tax incentives for investments in research and development.

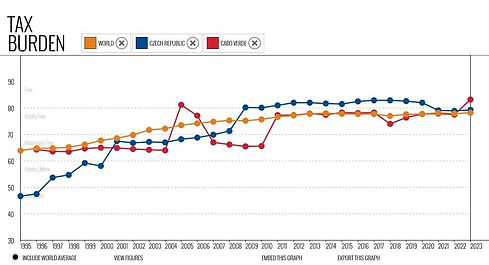

The tax burden in Cape Verde is lower than the world average and lower than in the Czech Republic. The graph is presented in terms of tax freedom: the higher the value, the greater the tax freedom.

7.Infrastructure

Cape Verde has a well-developed infrastructure network. Road density is relatively high and most of the national network is paved. Almost all the islands have ports and airports. There are currently three international airports. Cape Verde's infrastructure has improved in recent years. The country is investing in the development of transport, energy and telecommunications infrastructure. However, there are still some less accessible areas where the level of infrastructure needs to be improved.

8.Education and workforce

Education in Cape Verde is accessible and universal for students between the ages of 7 and 13. Secondary education focuses on the acquisition of scientific, technological and cultural knowledge to prepare children for the labour market. The quality of Cape Verde's workforce is generally good. People are generally well educated and young people have good language skills. The country is also investing in the development of education and training. It is common to speak English in a shop. Less so in the marketplace, but there is always a younger person there to help you. In Boa Vista, airport and security staff will even speak a few words of Czech to you.

9.Environmental and social factors

Cape Verde is bound by a number of international environmental and social agreements. The country is committed to sustainable development and environmental protection. Cape Verde also invests in social programmes such as health and education. There are also charitable organisations, including the Czech-Cape Verde Hope Cabo Verde Foundation, which aims to provide social education to the population and help those in need, especially children and single mothers. You can find out more about the foundation's activities here:

https://nadejecv.org/

10.Foreign Trade Policy

Cape Verde has a liberal trade regime. Foreign investors and companies receive the same or more favourable treatment than Cape Verdean citizens in terms of taxes, licensing and registration, and access to foreign exchange. Cape Verde is a member of the World Trade Organisation (WTO), the Economic Community of West African States (ECOWAS) and the African Union (AU). The country also has a number of bilateral free trade agreements with other countries.

11.Technological development

Cape Verde is investing in the development of its technological environment. The country has access to high-speed internet via two global backbone networks and offers a number of government programmes to encourage innovation. Here too, the resilient country is a pleasant surprise. According to the Global Innovation Index 2023, it ranks a very strong sixth in all of Africa in terms of innovation.

12.Demographic factors

According to the census, the population of Cape Verde is around three quarters of a million. Cape Verde has a young and growing population. In 2022, the average age in the country will be 27. This can be an advantage for investors looking for a young and skilled workforce.

Conclusion and forecast

Cape Verde has several of factors that make it an attractive destination for foreign investment. Its political stability, effective legal system, well-developed infrastructure and liberal trade policy are key factors for investors, as are its stable economy, favourable tax conditions and young and skilled workforce.

The admirable viability of Cape Verde's economy is also evident from the fact that GDP has already returned to, and even surpassed, the so-called pre-Cape Verdean level in 2022. Unfortunately, this cannot yet be said of the Czech economy.

However, it is important to note that like any country, Cape Verde has many challenges ahead. These challenges include the need to improve infrastructure, reduce the cost of some services and improve their quality.

Going forward, Cape Verde is expected to continue to strengthen its economy and improve its investment climate. Given its strategic location, political stability, and progress in infrastructure and education, Cape Verde has the potential to increase its attractiveness as a safe and reliable country for investors.

Leisure - activities

Cape Verde is the ideal place for an active holiday and a relaxing beach holiday.

The island with its perfect white sand beaches and clear sea beckons for water sports of all kinds. Especially diving, Shark Bay (Bahia das Gatas) on the east of Boa Vista is a renowned snorkelling site.

Other water sports include surfing, windsurfing, parasailing and kitesurfing, as well as fishing.

Blue marlin fishing is allowed on Cabo Verde and championships are held there.

Sal Island's salt mines are popular for their healing properties.

Golf lovers can enjoy the Viveiro Golf & Country Club on Sal.

For hiking enthusiasts, the evergreen, beautiful Serra da Malagueta mountain range on Santiago Island is ideal. Pico de Fogo, a fiery mountain full of life, invites you to hike up the volcano (it reaches 2,829 metres above sea level).

Carettas on Boa Vista - Ervatão beach is the third most important nesting site of the kareta turtle in the world.

Cidade Velha - the first city of the islands, built by the Portuguese in 1462. From here the settlement of the islands. It is also Cape Verde's only contribution to the UNESCO World Heritage List. It is located on Santiago Island.